EMI Calculator App Introduction

Introduction

The EMI Calculator is a remarkable tool that has revolutionized the way people manage their finances, especially when it comes to loans. In today's fast - paced world, where loans are an integral part of major purchases like homes, cars, personal needs, and education, having a reliable and efficient EMI calculator is of utmost importance.

Understanding the Basics of EMI

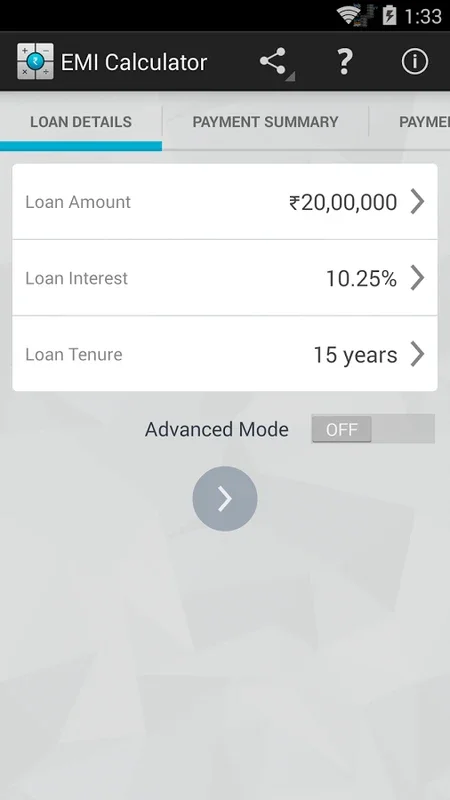

EMI, or Equated Monthly Installment, is the fixed amount that a borrower has to pay to the lender every month over a specified period of time. It consists of both the principal amount and the interest charged on the loan. The EMI Calculator simplifies the complex process of calculating this amount. By inputting key details such as the principal amount of the loan, the tenure (the number of months or years for which the loan is taken), and the interest rate, the calculator can quickly determine the EMI. This not only saves time but also provides accurate results, which are crucial for financial planning.

Features of the EMI Calculator

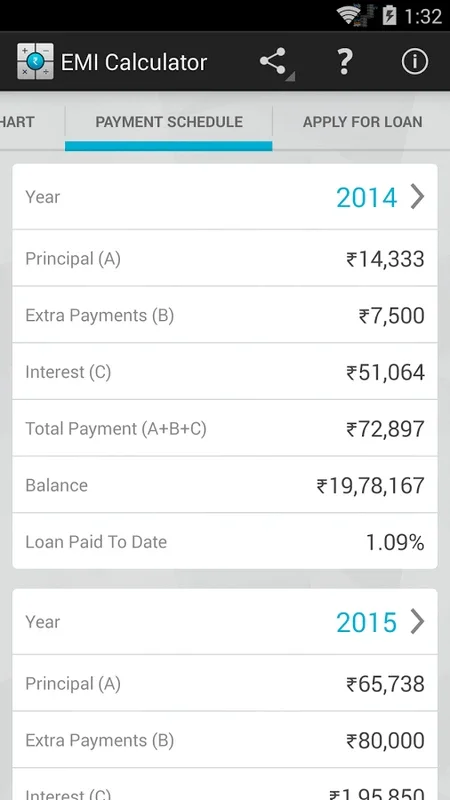

Input Flexibility

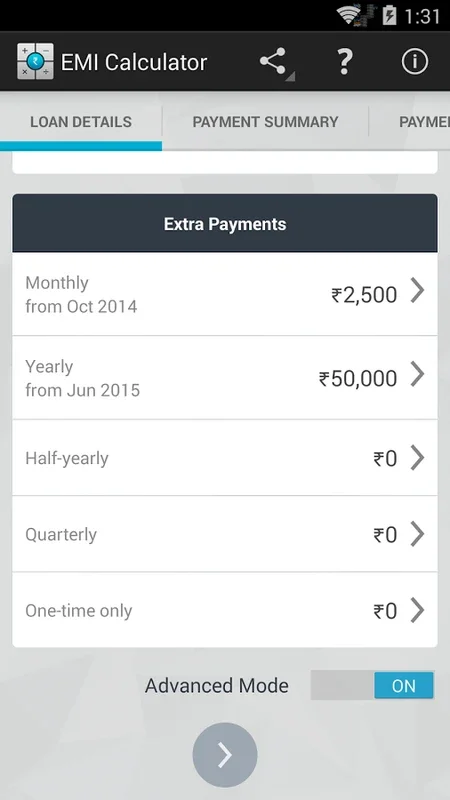

The EMI Calculator offers a great deal of flexibility when it comes to inputting loan details. In addition to the basic requirements like principal, tenure, and interest rate, it also allows for the inclusion of additional fees or charges. This is particularly important as many loans come with various types of fees such as processing fees, documentation fees, etc. Moreover, it also provides options to input factors like the EMI scheme, start date of the loan, and prepayments. This comprehensive input system ensures that the resulting payment summary is as accurate as possible, providing a detailed breakdown of the principal and interest components of the loan.

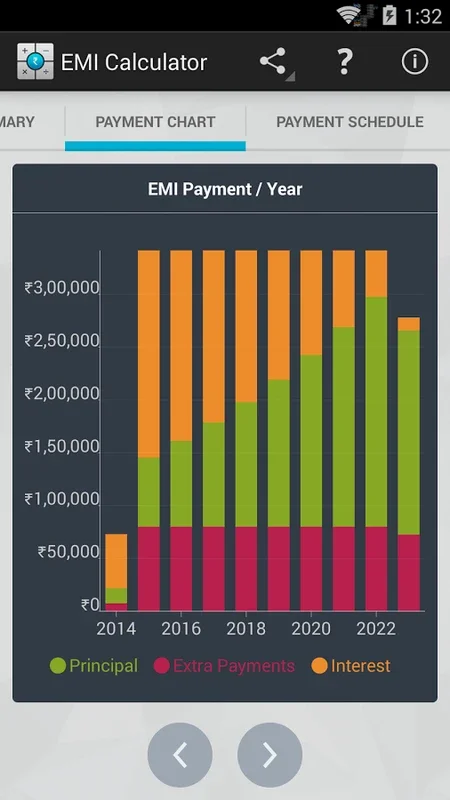

Visual Representation

One of the most appealing features of the EMI Calculator is its ability to present results in a visually appealing manner. Along with instant calculations, it provides colorful charts that help users better understand their loan repayment structure. These charts can be extremely useful in visualizing how the EMI is divided between the principal and the interest over the tenure of the loan. It also helps in understanding the impact of different factors such as changes in the interest rate or prepayments on the overall loan repayment.

Prepayment Analysis

Prepayments can have a significant impact on the total interest paid and the loan tenure. The EMI Calculator has a built - in feature that allows users to analyze the effect of prepayments on their loans. By inputting the amount of prepayment, the calculator can show how it reduces the total interest payable and shortens the loan tenure. This is a valuable feature for borrowers who want to save on interest costs and pay off their loans faster.

Advanced Calculator Mode

For more sophisticated financial analysis, the EMI Calculator offers an Advanced Calculator mode. In this mode, users can factor in extra payments with ease. This is especially useful for those who have irregular income streams or want to make additional payments towards their loans from time to time. The calculator can accurately recalculate the EMI and the loan tenure based on these extra payments, providing a more detailed and accurate picture of the loan repayment schedule.

APR Calculation

The Annual Percentage Rate (APR) is an important metric for understanding the true cost of a loan. Many loans have nominal interest rates that do not include additional fees. The EMI Calculator computes the APR, which takes into account all the costs associated with the loan, including fees. This helps borrowers make more informed decisions when comparing different loan offers.

Sharing Loan Details

The EMI Calculator also offers the convenience of sharing loan details and payment schedules. In today's digital age, it is often necessary to share financial information with various stakeholders such as family members, financial advisors, or business partners. The app allows users to share this information through popular communication channels like email, SMS, or note - taking apps. This ensures that all parties involved can have a clear understanding of the loan details and can contribute to the financial planning process.

Updates and Improvements

The developers of the EMI Calculator are constantly striving to improve the app's functionality. Over time, it has undergone a series of updates that have enhanced its capabilities. These updates include additional calculation capabilities, upgraded chart and math libraries. The improved chart libraries result in better - quality visual representations of loan data, while the enhanced math libraries ensure more accurate calculations. The user - friendly navigation has also been refined, making it easier for users to access and use all the features of the app.

Importance of Internet Access

While the EMI Calculator can perform most of its functions offline, internet access is required for certain features. Internet access is mainly used to support ads and analytics. Ads help to keep the app free for users, while analytics provide valuable insights to the developers about how the app is being used. This information is then used to further improve the app and enhance the user experience.

Conclusion

In conclusion, the EMI Calculator is an invaluable tool for anyone who has a loan or is planning to take one. Its comprehensive features, including accurate EMI calculations, visual representations, prepayment analysis, advanced calculation modes, APR calculation, and the ability to share loan details, make it a must - have for effective financial management. With continuous updates and improvements, it is likely to remain a popular and reliable choice for borrowers in the future.